In part one of this article, (Click here if you have not yet read it) I explained how to simplify your finances by just completing a few simple exercises on a piece of paper and I explained the three scenarios that you are probably in right now. So let’s continue our discussion right now. If you are currently in Scenario 1, you would want to move up to scenario 2 and scenario 3 immediately right? And if you are in scenario 2, your end goal is to get to scenario 3 as soon as possible.

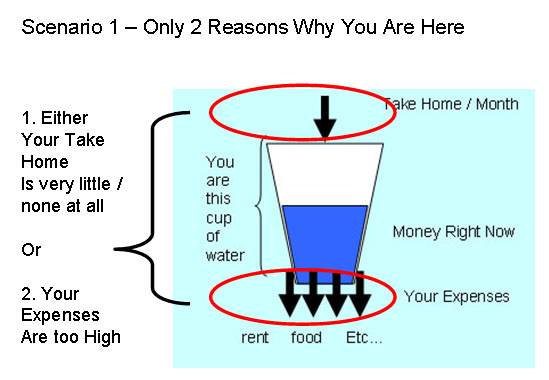

Well, let’s get started then. If you are in Scenario 1 (or 2), take a look at the picture below:

So here’s what you do about it. Don’t worry, I’m not going to tell you to just live below your means as this is what 99% of people try to do and still be in this predicament. The real solution is that you must work on the two problems together, not just lower your expenses, but work on increasing your take home. In this article (Part 2) I’m going to teach you how to first fix your spending habits, then in the next article (Part 3) We will tackle how to you start increasing your income.

So let’s talk about expenses first.

As the picture shows, the first thing you need to know is that there are three kinds of expenses.

- The Necessary – These are the only necessary expenses any one needs. These are:

- Food

- Clothing

- Shelter

- Transportation

- Education (if you have kids)

- Health Insurance (Phil health should be enough for now)

Regarding insurance, if you must prioritize between life, non-life, or health, then always get health insurance first. At this day and age when health costs are ridiculously expensive, not having this can bankrupt anyone if he/she gets hospitalized for a prolonged period. (If you have Phil health, that is enough for now)

- The Bad – These are expenses that have no value after you have spent your money, I also call them useless expenses. These are:

- Pleasure Expenses (Eating in fancy restaurants, taking expensive vacations, etc.)

- Vice Expenses (Smoking, Drinking, Gambling, etc.)

- Buying Items that cannot be rented out

- Buying Items that cannot be re-sold at same or higher values.

- Inexperienced Investing (lack of experience in knowing the difference between a scam and a true investment)

- Debt / loans used to pay for any of the above expenses

- The Good – These are expenses that produce “assets”. Assets are things or experiences that will add to income and your money right now. These are:

- Learning Expenses (Self-Help / How-To Books, Great Seminars, etc.)

- Buying Items that can be rented out

- Buying Items that can be used, re-sold at same or higher values

- Savings / Time Deposits with built in life insurance policies

- Experienced Investing

- Life/Pension Insurance

- Charity / charitable causes (if you give some to certain charities who really need it, it will come back to you a hundred fold through other means)

Notice that I included Savings, Investing, and Insurance as “expenses” this is because with my method, everything that goes out of your “cup” I treat as an expense. But, in this case, it is a good kind of expense.

Now the next thing you have to do is to make some sacrifices and adjust your spending habits. Reduce the Bad Expenses, Keep the Necessary Expenses, then Increase the Good Expenses

Yes, I know, you are thinking: “Easier said than done” Sure it is, I never said it was going to be easy, but, if you have the right mindset, I’m going to make it fun for you. Ready? This key to be able to do what I call:

Expense Management through “Substitution”

Here’s how it works, on another piece of paper, create a table like below, and write the heading for each column, “Bad”, “Necessary”, and “Good”. Then list down in the bad column all the expenses you have right now that have no value after you spend on them. (Yes, just the Bad Expenses, leave the other 2 columns blank)

Ex.

|

Bad |

Necessary | Good |

| Eating Out | ||

| Vacation in a province | ||

| Investing in a “get-rich-quick” scam |

Good, now cross out at least one (or as many ) of them and put in a “substitute” expense in either the “Necessary” or “Good” Column, like this:

| Bad | Necessary | Good |

| Eating Out | Go to market and cook my own food | |

| Vacation in a province | Buy a low cost computer that you can use in business and even rent out | |

| Investing in a get-rich-quick scam | Buy a book on how to invest |

For me (and my wife), this exercise has already become so natural with us that we automatically filter in our minds any expense that comes our way, we know if it’s a bad, necessary or good expense. But more importantly, we follow the very simple rule that I just explained –We do not indulge in Bad expenses, but we do not hesitate to spend on good ones. If we have a substitute expense for it either in the Necessary or Good expense column, we will always substitute it. Make this a habit and you will see that over time, this will be how your expenses will now look like:

Okay, for now your exercise will be to start managing your expenses by substitution. This time however, I would love to hear from you on what you have done about your finances at this point. Do send me a quick hello by email: markso@zerocapitalclub.com Stay tuned for part 3, because in that article, I will be talking about increasing your Take Home / Month. Which is absolutely essential for you to reach scenario 3. Good luck and I hope to hear from you soon!

Click here to continue reading

Money management simplified Part 3

Author box:

Mark So is a fervent businessman, forex trader and educator. He is the Chairman and CEO of Businessmaker Academy—a business, finance and corporate training center. He is also the Chief Forex Trainer of Forex Club Manila. Mr. So and his wife Jhoanna Gan-So regularly teach their straff to manage their money responsibly and have created a money coaching club for their employees. If you would like to start a money coaching club for your company, email Mark directly at markso@zerocapitalclub.com. To read more of Mark’s interesting and life enriching articles you can go to his blog at http://www.markso.wordpress.com

[…] Click here for Part 2 where I will explain how to get from scenario 1 to scenario 3. By the way, this method of money management is what me and my wife practice day in day out. This is called the “Simple Cashflow Method” which I have simplified even more to get as many of you started in managing your money properly. […]

wow!what you say is true.it means that we need to concentrate to important things first.be practical or clever.

Thanks Michael, hope this article changes your lofe for the better. Do let me know if you are able to do the exercise and the results in about a month.

All the best!

-Mark

This is what we should all learn to practice by heart if we want to uplift our lives and and help uplift the lives of others as well. This is actually plain common sense, yun nga lang in the area of money management ika nga ni Robert Kiyosaki, “Common sense is uncommon”. This kind of money management is very much doable, but it requires some strong sense of discipline.

Thanks for commenting saggi. I’m glad you agree that it is doable and yes like all things in this life that is worth doing, we do need to sacrifice and build discipline. I hope that this article helps you and a lot more people.

All the best!

-Mark

True enough. Wise people think of ways to simplify and maximize existing resources. Thank you once again for sharing this. I call this social responsibility – voluntarily extending help to others by sharing innovative techniques. Again, more power!

Thanks Mel. Helping people in my view is a privelage, but more importantly, the articles and seminars that I give are truly meant to create results. And my hope is that it creates a better result for you and your friends. Keep reading, keep sharing, keep learning

All the best!

-Mark

nice sir… I’ll do apply that now…

right you are about good and bad expenses. the problem of most people is that they want something and want to have it immediately… most would take out loans just to buy what they want. the sad part is that when you ask them why couldn’t they just save for it, atleast the most part of the cost, they would say : they can’t do it, that they keep on spending it for some other things… they complain that life is hard and that their salary is not enough and most of it goes to paying up debts. i just have to say that :”WALA SILANG BAIT SA SARILI”

they can’t control themselves, they couldn’t do what Kiyosaki say “delaying self gratification”… they take out loans, lie as to their capacity to pay, and tell themselves “MAY AWA ANG DIYOS”…

Very good insight Benjoe! Managing money is not all fun, there must definitely be sacrifices. The process is long, hard and brutal. But, if there are people willing to change, I hope they will listen to your comment.

All for the best for everyone!

-Mark

Thanks Mark,

This will be a great guide for me and my wife.

Look forward for the part 3.

More power!

Best regards

You are very welcome Juvy! Part 3 will be there soon enough. Please do let me know after a month if the exercise has helped you and your wife. Keep reading, keep sharing, keep learning. -Mark

——————————————————————————————————— Businessmaker Academy, Inc. Address: 1503A West Tower, Philippine Stock Exchange Bldg (Tektite), Exchange Road, Ortigas Center, Pasig City, Philippines Tel Nos.: (632) 6874445, 6873416 Telefax No.: (632) 6874645 Email: sales@businessmaker-academy.com Website: http://www.businessmaker-academy.com

Yo!

I’ve met a friend recently and he surprised me with really great news, please read it here http://issue.localstalk.co

See you around, Mark So

Hi,

Just take a look at that! That stuff is just so cool, iI love it! Please check it out here http://lfoz.pl/logical.php?8283

Sincerely yours, Mark So

Hello friend,

Mizan news agency, the mouthpiece of Iran’s judiciary, identified the American as Xiyue Wang, 37, a http://school62.dp.ua/escapex.php?bbba

Best wishes, Mark So

Dear friend!

Users can add their PayPal accounts to Samsung Pay and use their PayPal wallet anywhere Samsung Pay http://djk-bocklemuend.de/graduatex.php?9f9e

Faithfully, Mark So

Hi!

I’ve just made a report that is based just on hard facts, you can find it here http://sidigas.com/one.php?9a9b

See you around, Mark So

Greetings!

I’ve just found some stuff that may be really interesting for you, it is really cool) Take a look http://figueroapps.com/english.php?c8c9

All the best, Mark So

[…] This post was mentioned on Twitter by Tenley James. Tenley James said: Money Management Simplified (Part 2) « Business Advice by Mark So: Tagged with continuation of moneymanagement sim… http://bit.ly/aOhmmO […]

At this time your posted article helped me in some way! Now I can monitor all expenses that me and my husband make and consider the fact of increasing our so called take home pay even we earn very little. Thanks!

Hi May, I’m glad that you have already done part 1 I hope part 2 if my article, especially the substitution exercise will help you even more. Part 3 should be out soon so stay tuned for that.

All the best!

-Mark

Mark,

Great ideas. I really appreciate what you are doing. These are practical lessons that all us should learn. I am grateful.

Fred

Mark,

Great ideas. I really appreciate what you are doing. These are practical lessons that all of us should learn. I am grateful.

Fred

Very Welcome Fred! Glad you got to read my previous articles too! Keep Reading, Keep learning, keep sharing!

thanks for the tips to manage money. hope to read more articles from you about money management/entrepreneurial activities

Same here Fred! All the best!

Hi Sir Mark,

I’m glad that there are generous people like you sharing precious knowledge which probably others would keep for themselves. I need this and I’m so happy I read your article. Thanks and I’m looking forward in seeing you again. more power to you and your family. God Bless!

Long time no hear David! Yes I do hope to see you soon. All the best, all the time!

Sir Mark,

I happened to read your column today in Manila Bulletin and tried to visit your blog. I’m really glad that there is someone like you who is trying to reach every Filipino to become financially independent and make the most out of our lives.

Thank you so much.

Very welcome. Keep reading, keep learning, keep sharing.

Mr. Mark,

Can i ask any basic book or reference which i could learn stuff like this? I would be glad if it would be not so simple but not so deep kind of book. Thx!

Hi Ralph, just come back to my blog, I’m sure there are lots, but I have not seen any quite as what you need 😉

Some good learnings …..to purchase things that can be rented or sold. God bless

Hope you get to use the learnig for profit 🙂

Thanks.I will apply everything you said.You will hear from me as soon as I progresses.

More power to you.

Gibo

Very welcome Gilbert. Looking forward to hear from you soon.

[…] In part one of this article, (Click here if you have not yet read it) I explained how to simplify your finances by just completing a few simple exercises on a piece of paper and I explained the three scenarios that you are probably in right now. So let’s continue our discussion right now. If you are currently in Scenario 1, you would want to move up to scenario 2 and scenario 3 immediately right? And if you are in scenario 2, your end goal is to … Read More […]

great article! hope to have part 3 soon 🙂

Hi Jon, part 3 is here: http://wp.me/pjUVO-3a

its very basic… right?! 🙂 many of filipino’s new it already but the problem is mind setting… You know what sir… I will share this knowledge to my bro. and sisters and relatives… Iam praying that God will give you more strength and more wisdom and good health as well… Thank you sir! thank you!

Thank you once again Leo. God does give me strength, but people like you, give me hope that there is still something that I can do to help.

Thank you for the inspiration!!! More power to you in all your projects sir!

Hi Keith, glad to have inspired you. Do come back and tell all your friends and acquaintances. I’m sure like me, they will appreciate it. Talk soon!

This is a good article. I used to have 2 columns only when doing budgeting: money in, and money out (ie, expenses). I had always thought expense is just money going out. Now I know, there is such a thing as good expense. This article also interesting in that budgeting is likened to dieting- I don’t have to deprive myself of things I want, but I just have to find a more sensible expense to substitue for the bad expense. I am applying this now in my monthly budgeting. More power!

Hi Jackie, thanks for writing in. I’m glad you are following my advice. It really works.

Do keep coming Back for more articles and tell your friends. Talk soon

i liked the part where you advised not to live just below your means but analyze your expenses and doing substitution instead of Good expenses…. useful first step in meeting one’s financial goals….thanks !

Very welcome Patty. I can see that you are really going through the articles. Keep it up!

Great Article Mark!!!

Thanks Ella!

The illustrations you’ve shown make it so easy to understand! Thanks Mark! I’ll share this to my friends! I’ll definitely promote this site.

Excellent. The fastest way to do that is to share this on Facebook. At the end of each article is a Facebook share button. Go ahead and click on that. Thanks! Do continue reading Money Management Simplified Part 3. Talk soon!