In part one of this article, (Click here if you have not yet read it) I explained how to simplify your finances by just completing a few simple exercises on a piece of paper and I explained the three scenarios that you are probably in right now. So let’s continue our discussion right now. If you are currently in Scenario 1, you would want to move up to scenario 2 and scenario 3 immediately right? And if you are in scenario 2, your end goal is to get to scenario 3 as soon as possible.

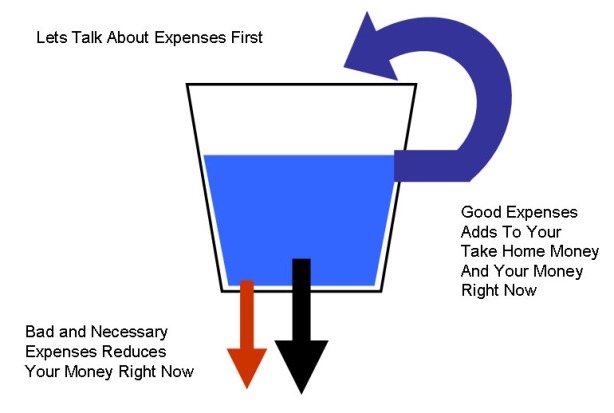

Well, let’s get started then. If you are in Scenario 1 (or 2), take a look at the picture below:

So here’s what you do about it. Don’t worry, I’m not going to tell you to just live below your means as this is what 99% of people try to do and still be in this predicament. The real solution is that you must work on the two problems together, not just lower your expenses, but work on increasing your take home. In this article (Part 2) I’m going to teach you how to first fix your spending habits, then in the next article (Part 3) We will tackle how to you start increasing your income.

So let’s talk about expenses first.

As the picture shows, the first thing you need to know is that there are three kinds of expenses.

- The Necessary – These are the only necessary expenses any one needs. These are:

- Food

- Clothing

- Shelter

- Transportation

- Education (if you have kids)

- Health Insurance (Phil health should be enough for now)

Regarding insurance, if you must prioritize between life, non-life, or health, then always get health insurance first. At this day and age when health costs are ridiculously expensive, not having this can bankrupt anyone if he/she gets hospitalized for a prolonged period. (If you have Phil health, that is enough for now)

- The Bad – These are expenses that have no value after you have spent your money, I also call them useless expenses. These are:

- Pleasure Expenses (Eating in fancy restaurants, taking expensive vacations, etc.)

- Vice Expenses (Smoking, Drinking, Gambling, etc.)

- Buying Items that cannot be rented out

- Buying Items that cannot be re-sold at same or higher values.

- Inexperienced Investing (lack of experience in knowing the difference between a scam and a true investment)

- Debt / loans used to pay for any of the above expenses

- The Good – These are expenses that produce “assets”. Assets are things or experiences that will add to income and your money right now. These are:

- Learning Expenses (Self-Help / How-To Books, Great Seminars, etc.)

- Buying Items that can be rented out

- Buying Items that can be used, re-sold at same or higher values

- Savings / Time Deposits with built in life insurance policies

- Experienced Investing

- Life/Pension Insurance

- Charity / charitable causes (if you give some to certain charities who really need it, it will come back to you a hundred fold through other means)

Notice that I included Savings, Investing, and Insurance as “expenses” this is because with my method, everything that goes out of your “cup” I treat as an expense. But, in this case, it is a good kind of expense.

Now the next thing you have to do is to make some sacrifices and adjust your spending habits. Reduce the Bad Expenses, Keep the Necessary Expenses, then Increase the Good Expenses

Yes, I know, you are thinking: “Easier said than done” Sure it is, I never said it was going to be easy, but, if you have the right mindset, I’m going to make it fun for you. Ready? This key to be able to do what I call:

Expense Management through “Substitution”

Here’s how it works, on another piece of paper, create a table like below, and write the heading for each column, “Bad”, “Necessary”, and “Good”. Then list down in the bad column all the expenses you have right now that have no value after you spend on them. (Yes, just the Bad Expenses, leave the other 2 columns blank)

Ex.

|

Bad |

Necessary | Good |

| Eating Out | ||

| Vacation in a province | ||

| Investing in a “get-rich-quick” scam |

Good, now cross out at least one (or as many ) of them and put in a “substitute” expense in either the “Necessary” or “Good” Column, like this:

| Bad | Necessary | Good |

| Eating Out | Go to market and cook my own food | |

| Vacation in a province | Buy a low cost computer that you can use in business and even rent out | |

| Investing in a get-rich-quick scam | Buy a book on how to invest |

For me (and my wife), this exercise has already become so natural with us that we automatically filter in our minds any expense that comes our way, we know if it’s a bad, necessary or good expense. But more importantly, we follow the very simple rule that I just explained –We do not indulge in Bad expenses, but we do not hesitate to spend on good ones. If we have a substitute expense for it either in the Necessary or Good expense column, we will always substitute it. Make this a habit and you will see that over time, this will be how your expenses will now look like:

Okay, for now your exercise will be to start managing your expenses by substitution. This time however, I would love to hear from you on what you have done about your finances at this point. Do send me a quick hello by email: markso@zerocapitalclub.com Stay tuned for part 3, because in that article, I will be talking about increasing your Take Home / Month. Which is absolutely essential for you to reach scenario 3. Good luck and I hope to hear from you soon!

Click here to continue reading

Money management simplified Part 3

Author box:

Mark So is a fervent businessman, forex trader and educator. He is the Chairman and CEO of Businessmaker Academy—a business, finance and corporate training center. He is also the Chief Forex Trainer of Forex Club Manila. Mr. So and his wife Jhoanna Gan-So regularly teach their straff to manage their money responsibly and have created a money coaching club for their employees. If you would like to start a money coaching club for your company, email Mark directly at markso@zerocapitalclub.com. To read more of Mark’s interesting and life enriching articles you can go to his blog at http://www.markso.wordpress.com